how to pay philadelphia property tax

Makes it easy to pay City of Philadelphia real estate taxes and other bills using your favorite. Review the tax balance chart to find the amount owed.

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

The following taxes can be paid online through the Philadelphia Tax Center.

. Debit or credit card fees apply By mailing a check or. You can contact us at 215 686-2918 or ROWITaxphilagov. Call 215-686-9200 to check.

We begin to fill in the fields. Payment Number and Access Code or Notice Number and OPA Number or Company ID and Tax ID or be a Registered User. How to make a payment.

Make your payment online. This tax break for owner-occupied properties. By Modernized e-Filing MeF By mail.

Reasonable property worth appreciation wont raise your. You may need the following information before you pay online. Pay City of Philadelphia Real Estate Taxes and Other Bills Online and On Time ACI Payments Inc.

Set up a Real Estate Tax payment plan. Use the Real Estate Tax portal by entering the physical address or Office of Property Assessment OPA number. Pay your real estate taxes online using the Citys Real Estate Tax site by.

Debit or credit card fees apply By calling 877 309-3710 Pay with eCheck FREE. Then we accept the Terms and Conditions of the Page click on Accept. As a last resort if property taxes remain unpaid tax delinquent properties can be sold to the highest bidder at monthly Sheriffs Sales.

Set up an Owner-occupied Real Estate Tax Payment Agreement OOPA Submit an Offer in Compromise to resolve your delinquent business taxes. How do I pay my Philadelphia property taxes. Use the Property App to get information about a propertys ownership sales history value and physical characteristics.

Enter the address or 9-digit OPA property number. Visit the Department of Revenue How to file and pay City taxes page. Sales are held at 3801 Market Street First District.

Our Philadelphia County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. Figure out the amount your actual real estate tax payment will be with the higher value and any tax exemptions you are allowed. You will be able to check your tax balance and make a.

How to pay City taxes. All the Info You Need on Philadelphia Property Tax Assessment. Makes it easy to pay City of Philadelphia real estate taxes and other bills using your favorite debit card credit card or electronic check.

Set up an Owner-occupied Real Estate Tax Payment Agreement OOPA Submit an Offer in Compromise to resolve your delinquent business taxes. Seniors who live in Philadelphia Pittsburgh or Scranton where local wageincome tax rates are very high will not benefit from a local tax shift to lower taxes on top of the reduction offered by. When it comes to paying property taxes you might end up.

You can also generate address listings near a. The Current Year Installment Plan takes your. Pay online through the Citys Real Estate Tax portal by entering your physical address or Office of Property Assessment OPA number.

Set up a Real Estate Tax payment plan. Property tax in Philadelphia County is calculated by multiplying the taxable value with the corresponding tax rates and is an estimate of what an owner not benefiting from tax. Online Pay with eCheck FREE.

If your property is your primary residence the homestead exemption is the best place to start. You can onlyin English Spanish and ChineseSenior FreezeThis senior citizen real estate tax freeze will stop your property taxes from going up. Our office hours are Monday through Friday 8 am.

To find and pay property taxes. To pay the Philadelphia Property Tax with E-check select the option and click on Continue. In the USA there are only two certaintiesdying and paying taxes.

Choose options to pay find out about payment. Look for existing relief options.

What Pa Home Buyers Need To Know About Taxes Main Line Real Estate Jennifer Lebow Realtor

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

Philly Released 2023 Property Assessments Here S How To Calculate Your Property Tax Venture Philly Group

City Of Philadelphia Extends Property Tax Business Tax Deadlines

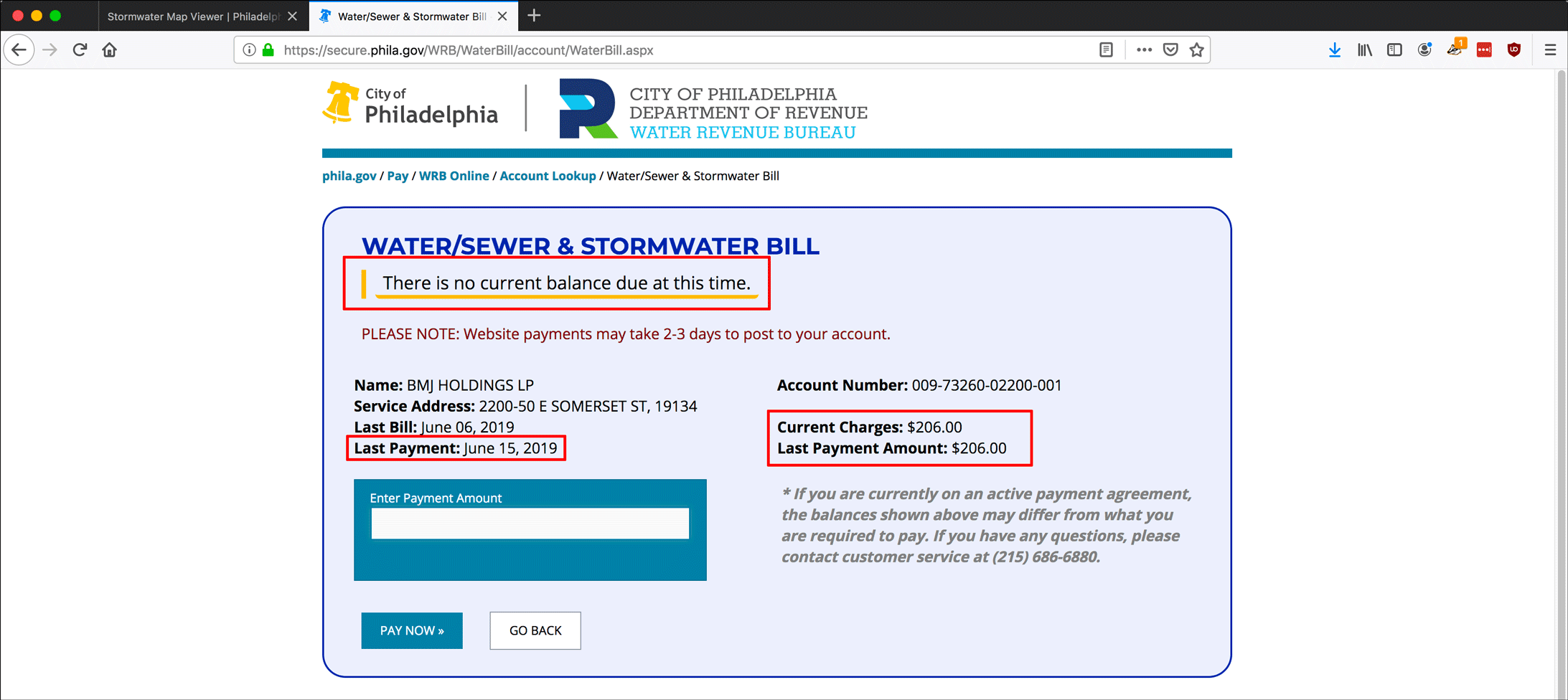

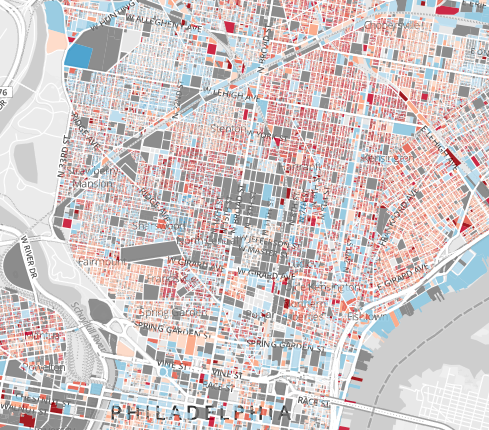

Public Record Property Investigation Philadelphia Edition Massolit Media Com

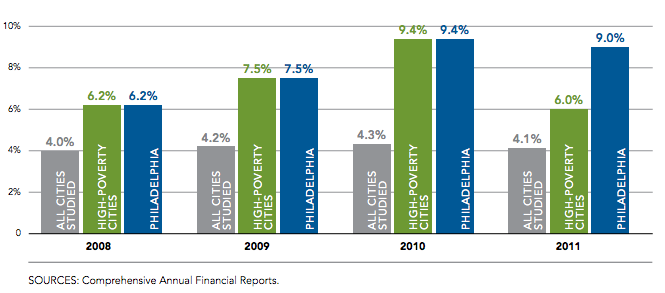

Philadelphia Property Tax Reform A Progressive Alternative Campus Activism The Blog

Efficient Property Tax Collections Vs The Cult Of Homeownership

Kenney Proposes City Wage Tax Reduction As Surging Philadelphia Home Values Increase Property Tax Burden Nbc10 Philadelphia

Philadelphia S Mayor Signs Major Property Tax Relief Legislation Mychesco

City Announces Update On Property Tax Assessments Including Timing Of Written Notices The Philadelphia Sunday Sun

City Councilmember Johnson Introduces Property Tax Relief Plan Local News Phillytrib Com

Property Tax Bill Gone Missing Here S How To Get A New One Department Of Revenue City Of Philadelphia

Weekly Report Members Pledge To Mitigate Impact Of Increased Property Tax Assessments On Philly Homeowners Philadelphia City Council

Philly 10 Year Tax Abatement To Shrink Under Domb Bill Whyy

Did Your Property Taxes Go Up Here S How To Make Your Tax Bill More Affordable

Tax Assessment Appeal In Philadelphia Pa

Philly S 2020 Assessments Are Out Here S How To Calculate Your New Tax Bill

Avi Calculator Use This City Of Philadelphia App To See Historic New Property Reassessments Technical Ly